With energy prices on the rise, monthly utility bills are catching many consumers by surprise.

Rate shock occurs when utility rates increase so sharply that some customers struggle to pay their bills. Rate shock is stressful and disruptive to people’s day-to-day lives, wreaking havoc on household budgets.

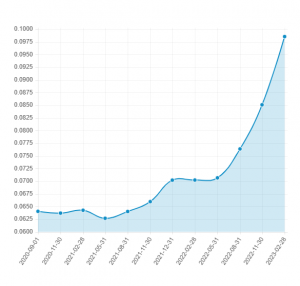

Consumers, on average, paid 14.3% more for electricity last year than they did in 2021, which is more than twice the overall 6.5% increase other commodities saw from inflation, according to data released by the U.S. Bureau of Labor Statistics. Electricity to heat homes is expected to cost 10.2% more this winter compared to last year — that’s around $1,400 for the season, according to data from the National Energy Assistance Directors’ Association.

While volatility in the market always exists, it’s fairly unusual to see peak after peak for ten days or more. While consumers can expect energy prices to dip over the coming months, volatility is expected to return next winter.

Utility rates increase when there is volatility in the market. Natural gas is the marginal fuel in many power markets, meaning utilities use it to meet increases in power demands. So, when the cost of natural gas goes up, or there’s a short supply of natural gas, it impacts all electricity costs.

Right now, economists warn that electric bills will continue rising because liquified natural gas (LNG), which fuels more than one-third of our nation’s electricity, is still in short supply as the United States ships large amounts of LNG to Europe. These shipments replace the lost imports from Russia, which, due to the war with Ukraine, have dropped significantly.1

As such, default service (non-shopping) rates for electricity have spiked recently in Northeast states like Connecticut, Massachusetts, and Pennsylvania, leaving customers paying a heavy price.

A new study by Ownerly found Connecticut has the highest electricity bills in the continental United States. Connecticut’s average household, which only falls behind Hawaii on the list, has paid $2,077 in electric bills over 12 months through last September.

In Massachusetts, soaring electricity costs have left customers reeling. One of the state’s major utility companies, National Grid, reported in the fall that the monthly electric bills of an average residential consumer would increase by 64%, and the average monthly natural gas bill would increase by 24% for six months beginning Nov. 1. As the Boston Globe reported, some families experienced increases of more than 80% even though usage only went up 17%. Energy assistance programs in Massachusetts reported an increase of 8% more applications than last year.

In Pennsylvania, rates that non-shopping (default service) customers pay utilities for electricity have more than doubled in some cases between December 2020 to December 2022. On June 1, prices spiked between 8% and 46%, depending on the utility. Then, on Sept. 1, after another adjustment, costs rose again as much as 19%. The next rate adjustment on Dec. 1 had prices tripling from what consumers were paying just two years ago.

So, what can competitive energy markets do about it?

Consumers in 17 states nationwide have an option. In competitive retail electricity markets, customers have access to energy choice. This means they are not beholden to the default service rate and can shop around for better rates that are typically lower than the default service when rate shock occurs. Unlike utilities, retailers are able to base prices on a forward energy curve. That price can be lower, and it enables retailers to extend 3-36 month fixed-rate contracts, safeguarding customers from rate shock. In many instances, this market solution helps the customer save money, and budget more effectively, as their rates do not increase, despite changes in the overall market.

Using Pennsylvania as an example, as of April 2023, PECO’s price to compare sits at 9.72 cents per kWh.

For states hit hard by skyrocketing rates, like Connecticut, Massachusetts, and Pennsylvania, REAL created shopping guides for customers to use to learn more about current rate increase information and resources for how to shop and how best to compare suppliers.

It’s only natural to wonder – how do retail energy providers maintain price stability during times of volatility? The answer to this question stems from the nuances of how power is bought, sold, hedged, and supplied. Although competitive energy suppliers purchase energy from the same wholesale market as utilities, competitive energy suppliers have the leeway to purchase power in many different ways. Utilities, on the other hand, are completely subject to live market conditions, meaning they are exposed to price volatility and have no option but to purchase power at the current market price.

For example, a retail energy supplier may have purchased its energy via a long-term contract prior to the unprecedented rate hikes we’ve seen over the last year. In this case, a retail energy provider’s cost will be unaffected by the current market conditions, as it was able to secure energy long in advance at a fixed price. This is known as hedging, where a retail energy supplier buys energy in advance to offset any potential price spikes or dips. By doing so, they can offer their customers a more stable and predictable price for their energy consumption.

In summary, retail energy suppliers are able to maintain price stability during times of volatility through advanced purchasing strategies, and in doing so, they can offer customers a more predictable and stable price, while shielding consumers from the risks of the live market.

Beyond market solutions, there are also product solutions to help customers save money.

Some retailers offer smart time-of-use tariffs with digital apps and simple interfaces so customers can save money by dictating how and when their usage will increase and decrease. Others implement demand response with smart thermostats where retailers pay customers for the right to roll back energy usage during peak periods.

Energy efficiency programs also help retail energy suppliers maintain price stability for consumers. These programs encourage customers to use energy more efficiently, thus reducing overall energy consumption and the need to purchase more expensive energy during times of peak demand. By reducing overall energy usage, retail energy suppliers can lower the demand for energy and the cost of energy supply, which ultimately benefits customers by keeping prices stable.

Depending on the situation of each individual consumer, the opportunities abound.

Exceptional customer service is at the foundation of competitive retail markets because suppliers must earn every customer every day; customer service is especially important during times of rate spikes. Retail energy suppliers have offered initiatives like usage alerts, payment plans, and funds for low-income customers to support their customers during rate hikes.

Consumer protection requirements are always necessary, particularly during times of high rates. Many states list the rights and protections consumers have on the official sites for shopping (listed at the end of this blog post). For example, in Pennsylvania, there is a list of shoppers’ rights that consumers should review before getting started.

In the end, restructured markets provide customers experiencing rate shock with optionality to choose the best product for their needs; retailers are investing in innovative products that provide cost-savings with access to data and voluntary demand response programs. Customers have the opportunity to choose their preferred product, while retail suppliers are motivated to provide innovative cost-saving products beneficial for all parties involved.

While retail suppliers may not offer a product that beats standard service 100% of the time, its stability offers a haven for customers impacted by rate shock.

ELECTRIC CHOICE:

Connecticut: https://energizect.com/rate-board/compare-energy-supplier-rates

Delaware: https://depsc.delaware.gov/customer-electric-choice/

Illinois: https://www.pluginillinois.org/

Maine: https://www.maine.gov/meopa/electricity/electricity-supply

Maryland: https://www.mdelectricchoice.com/

Massachusetts: https://www.energyswitchma.gov/#/

New Hampshire: https://www.energy.nh.gov/engyapps/ceps/shop.aspx

New Jersey: https://www.energy.nh.gov/engyapps/ceps/shop.aspx

New Jersey: https://www.nj.gov/bpu/commercial/shopping.html

New York: https://documents.dps.ny.gov/PTC/home

Ohio: https://www.energychoice.ohio.gov/

Pennsylvania: https://www.papowerswitch.com/

Rhode Island: https://www.ri.gov/app/dpuc/empowerri

Texas: https://www.powertochoose.org/

Washington, D.C.: https://dcpowerconnect.com/approved-suppliers/