Customers who shop could save 30% or more on the supply portion of their electricity bills

Emerson College Polling has released findings from a recent survey of electric ratepayers in Connecticut and found that 89 percent of respondents believe they should be able to choose their electric supplier, even if they don’t always shop for an electric supplier.

In August 2022, Emerson College Polling surveyed 1,500 Connecticut residents to determine attitudes toward the state’s electric market and shopping preferences.

Key findings:

These findings come in the wake of unprecedented rate hikes from Connecticut’s utility providers and support the notion that energy choice in the energy marketplace results in the best prices and services.

Reasons for shopping also included the desire for bundled options that offer value-added products, price stability with a fixed price plan, and suppliers that offer more renewable, clean energy options than utility monopolies currently provide.

Even with the strong support for energy choice, the survey found that only 17% of respondents have exercised their ability to shop and enrolled with a competitive energy supplier. One explanation for this barrier is the challenge of providing support to a customer in a restructured market when the utility is the go between for billing and communication.

In 2022, the Connecticut Office of Consumer Counsel (OCC) reported that residential customers served by the state’s competitive suppliers saved $11,281,399 between January and October 2022.1 As of Dec. 2022, there were more than a dozen available offers for customers to take advantage of where they would pay less than the Eversource rate that began Jan. 1, 2023.

According to the Energy Information Administration, Connecticut had the 6th highest electric rates nationwide in 2021.2 As of February 2022, the most recent data available, Connecticut had the 3rd highest electric rates of any state in the lower 48.3 Despite this, respondents indicated they are willing to pay more for the value-added services noted below:

The willingness to pay more and level of importance placed on value-added products, specifically those that support clean energy goals, did not directly correspond to the annual income bracket. For example, 45% of respondents with an annual income of less than $25,000 selected renewable energy as a “very important” value-added product with 65% of those respondents willing to pay more for a renewable energy product. In comparison, only 31% of respondents with an annual income of $150,000+ selected renewable energy as a “very important” value-added product with 56% of respondents willing to pay more for renewable energy.

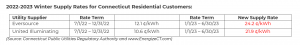

To help customers shop for price and protect themselves from further rate shock, the nonprofit Retail Energy Advancement League created a winter shopping guide that explains contract terms, how to compare product offers and other helpful shopping tips for shoppers in CT.